Oil prices tumbled this week amid news of a plan by U.S. President Joe Biden to cut fuel costs for drivers.

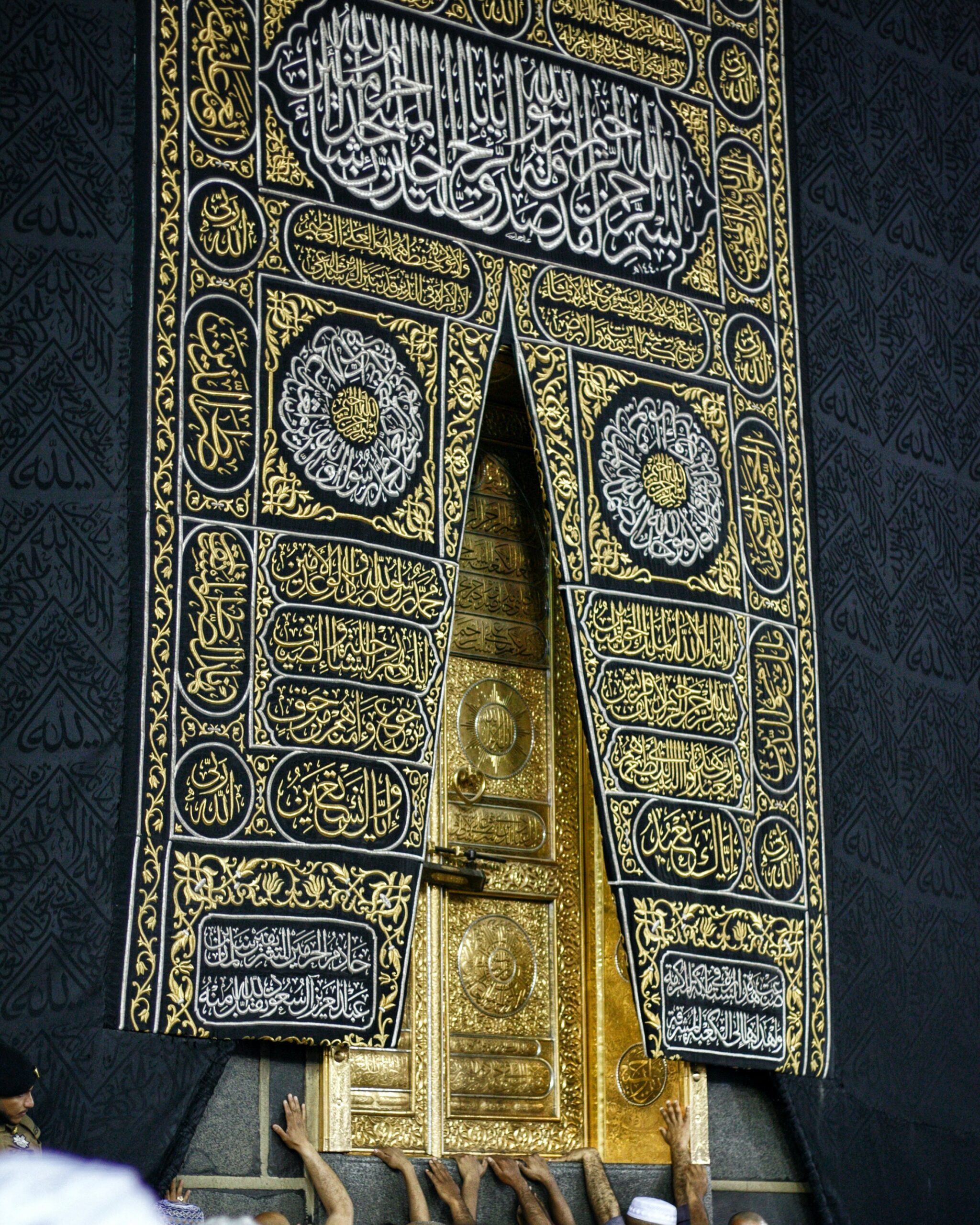

Photo by Nicholas Cappello on Unsplash

By Reuters, Team MEB

Stock markets in the Gulf retreated on Wednesday, tracking crude prices, and as global sentiment was weighed by persistent worries that rising interest rates would trigger a global recession.

Saudi Arabia’s benchmark index (.TASI) slid 2.9%, posting broad-based declines, dragged down by Al Rajhi Bank (1120.SE) a 4.3% drop and a 2.9% decline in Saudi National Bank (1180.SE), the country’s largest lender.

Oil prices, a key catalyst for the Gulf’s financial markets, tumbled on news of a plan by U.S. President Joe Biden to cut fuel costs for drivers.

The White House asked the chief executive officers of seven oil companies to a meeting this week to discuss ways to increase production capacity and reduce fuel prices of around $5 a gallon as they make record profits.

Dubai’s main share index (.DFMGI) closed 0.9% lower, with blue-chip developer Emaar Properties (EMAR.DU) losing 1.9%.

In Abu Dhabi, equities (.FTFADGI) declined 1.8%, with the United Arab Emirates’ biggest lender First Abu Dhabi Bank (FAB.AD) retreating 2.5%.

The Qatari benchmark (.QSI) was down 1.1%, with petrochemical maker Industries Qatar (IQCD.QA) dropping 2.5%.

U.S. Federal Reserve chair Jerome Powell is due to start his testimony to Congress on Wednesday, with investors looking for further clues about whether another 75-basis-point rate hike is on the cards in July.

Economists polled by Reuters expect the Fed will deliver a 75-basis-point interest rate hike next month, followed by a half-percentage-point rise in September, and won’t scale back to quarter-percentage-point moves until November at the earliest.

Investors focused on the impact of the tightening monetary policy on economic growth and the Federal Reserve’s next steps could cause a sharp slow down, said Farah Mourad, senior market analyst of XTB MENA.

Outside the Gulf, Egypt’s blue-chip index (.EGX30) lost 0.8%.

According to Mourad, the Egyptian market remains exposed to the developments in Ukraine as well the selling pressure from international investors.