Lebanon’s economic crisis deepened as inflation in Lebanon reached an annual rate of approximately 124% in January, according to the Central Administration of Statistics’ Consumer Price Index. This marks the 31st consecutive month of hyperinflation in the country, which has been hit by a severe economic and financial crisis that has lasted for decades. The inflation in Lebanon is primarily driven by rising communication, education, health, restaurant and hotel prices, along with increased food, water and energy costs.

Why is inflation in Lebanon so high?

The country’s political deadlock has prevented the formation of a new government and enactment of necessary reforms to unlock billions of dollars in aid. The CPI increased by 8.43% in January from December 2022. In 2021, inflation reached 155%, while it climbed to 171.2% in 2022, the highest rate in approximately four decades.

What are the worst affected sectors?

The costs of communication increased by 331% in January from the same month in 2022. Education, health, and restaurant and hotel prices also surged 191%, 176%, and 174%, respectively. Water, electricity, gas and other fuel prices rose 163% annually, while clothing and footwear prices, as well as food and alcoholic beverages, increased by 161% and 138%, respectively.

The costs of miscellaneous goods and services rose by 20% compared to December 2022, while restaurant and hotel prices increased by 18%. Health bills, food and non-alcoholic beverages, and the cost of water, electricity, gas, and other fuels jumped by 11% each.

What’s next for Lebanon?

Lebanon’s economy contracted by about 58% between 2019 and 2021, with GDP falling to $21.8bn in 2021 from about $52bn in 2019, according to the World Bank. The country’s tax revenue more than halved between 2019 and 2021 amid the deepest economic crisis since the civil war, according to the International Monetary Fund.

Could the IMF’s visit to Lebanon in March help?

In March, the IMF delegation is set to visit Lebanon and it is expected that the private sector will propose the creation of a fund to contribute to returning deposits to their owners. This proposal was previously suggested by former Economy Minister Raed Khoury. However, due to the Lebanese government’s failure to implement IMF reform conditions, there is uncertainty over the extent to which the IMF can involve the state in the losses and benefits of such a fund.

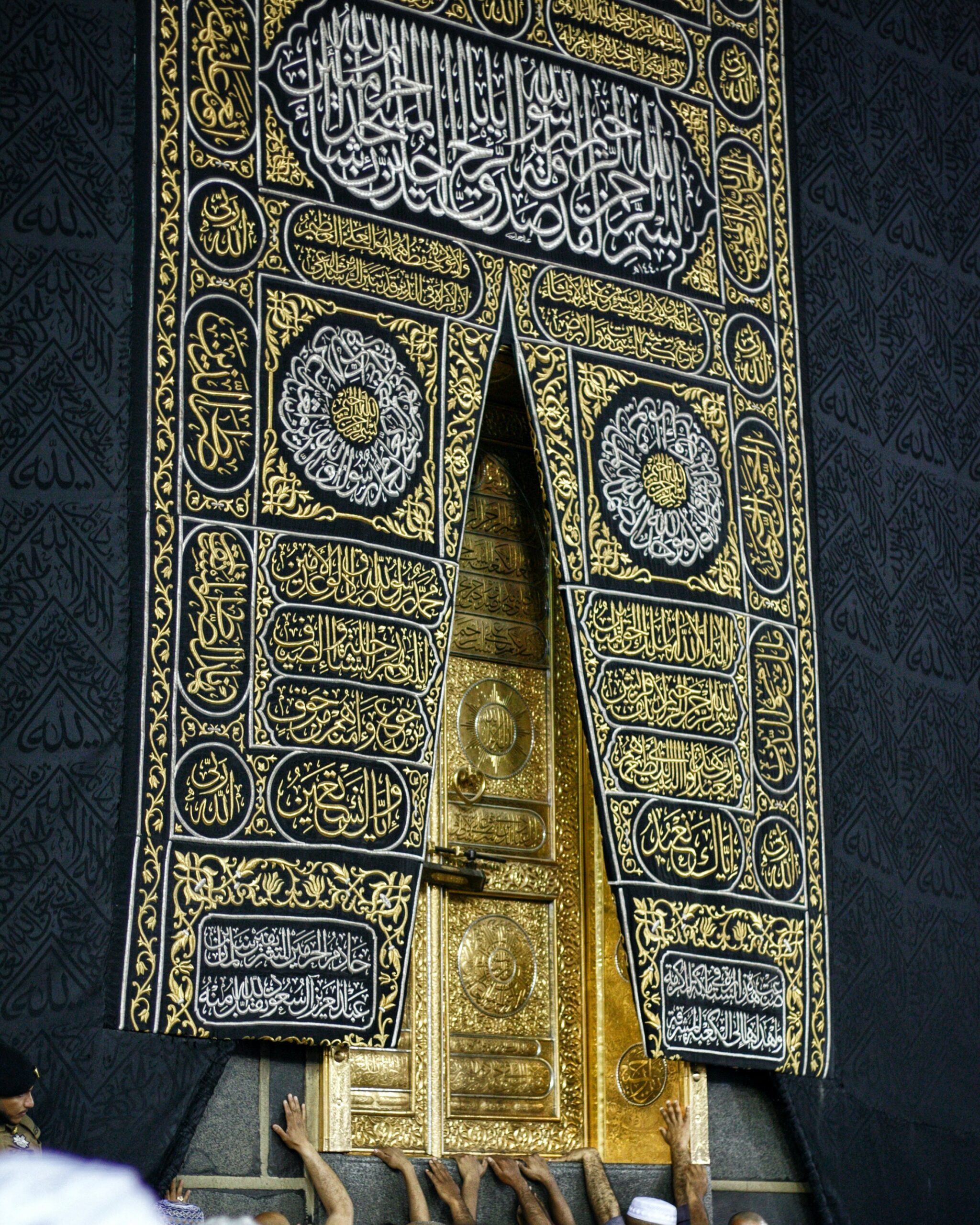

Image Credit: AP Photo/Bilal Hussein