Egypt has inked seven memoranda of understanding with international developers in the fields of green hydrogen and renewable energy in the Suez Canal Economic Zone, paving the way for a potential investment valued at approximately $40 billion over a decade, as per a statement from the cabinet released on Wednesday.

According to Planning Minister Hala al-Said, the initial phase anticipates an investment of around $12 billion, followed by an additional $29 billion earmarked for the first phase.

Over the past two years, Egypt has entered into a series of memoranda of understanding and framework agreements for the advancement of green hydrogen. The North African nation is striving to establish itself as a prominent green hydrogen and renewable energy centre, notwithstanding competition from other countries in North Africa and the Middle East.

Amid Egypt’s pursuit of green energy initiatives, the country grapples with its own economic challenges. Years of political instability, coupled with the impact of the COVID-19 pandemic, have strained the nation’s economy.

Egypt faces issues such as high unemployment rates, inflationary pressures, and a significant budget deficit, all of which underscore the importance of attracting substantial investments, like those in green hydrogen and renewable energy, to stimulate economic growth and development.

Furthermore, Egypt’s economic landscape has been influenced by the recent escalation of tensions and conflict in the Gaza Strip. The Gaza war, with its proximity to Egypt’s borders, has heightened security concerns and strained diplomatic relations in the region.

Egypt has been involved in mediating ceasefires and brokering peace talks, seeking to mitigate the impact of the conflict on its own stability and security. The repercussions of the Gaza war ripple beyond its borders, affecting Egypt’s geopolitical dynamics and regional stability, underscoring the need for concerted efforts towards lasting peace and stability in the region.

In recent years, Egypt has actively sought foreign investment to bolster its economy and mitigate its growing debt burden. The country has implemented economic reforms and initiatives aimed at attracting foreign capital and fostering a more business-friendly environment. These efforts have yielded some success, with significant foreign investment flowing into various sectors of the Egyptian economy, including energy, infrastructure, and manufacturing.

Moreover, Egypt has engaged with international financial institutions such as the International Monetary Fund (IMF) to address its economic challenges and secure much-needed financial assistance. In 2016, Egypt entered into a three-year $12 billion IMF loan program aimed at implementing structural reforms to restore macroeconomic stability, stimulate growth, and create jobs. The IMF program included measures to reduce subsidies, streamline public spending, and improve the investment climate.

While the IMF program helped stabilise Egypt’s economy and restore investor confidence, it also necessitated tough austerity measures and fiscal tightening, which placed a strain on the population, particularly the most vulnerable segments. The reduction of subsidies, in particular, led to price increases for essential goods and services, exacerbating the financial strain on low-income households.

Despite the IMF assistance and foreign investment inflows, Egypt’s public debt has continued to rise in recent years, reaching alarming levels. The COVID-19 pandemic further exacerbated the country’s debt situation, as the government implemented measures to contain the virus and support the economy, leading to increased borrowing and fiscal deficits.

Egypt’s growing debt burden poses significant challenges to its long-term economic sustainability and fiscal stability. The government faces the daunting task of balancing the need for continued investment in critical sectors such as infrastructure and healthcare with the imperative of fiscal consolidation and debt management.

Addressing Egypt’s debt challenges will require a multi-faceted approach that combines efforts to boost revenue generation, improve public financial management, enhance debt transparency, and pursue sustainable economic growth strategies. Moreover, attracting long-term, sustainable foreign investment will be crucial to diversifying the economy, creating jobs, and reducing reliance on external borrowing. Through prudent fiscal management and strategic economic reforms, Egypt can navigate its debt challenges and lay the foundation for inclusive and sustainable growth in the years to come.

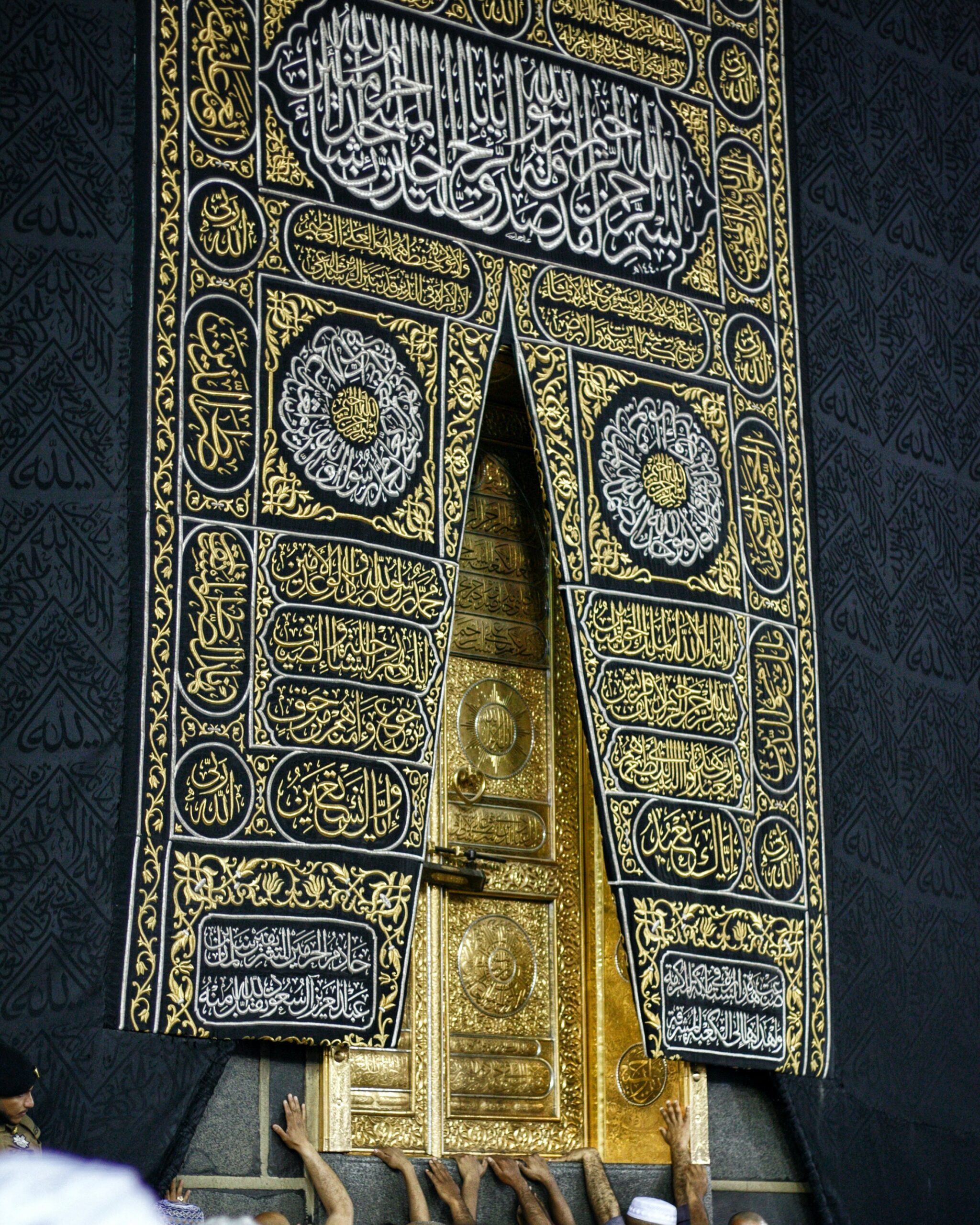

Image Credit: Graham Carlow / Wikimedia