Turkey has dramatically increased its fuel taxes by nearly 200% in an effort to recover expenses related to pre-election giveaways and the rebuilding costs stemming from a catastrophic earthquake in February. The taxes have been raised to TL7.53 per litre on regular petrol, and there has also been a noticeable increase on diesel and other petroleum products.

The significant tax hike, which has resulted in a 20% increase in fuel prices, is the latest in a series of measures introduced by President Recep Tayyip Erdoğan following his re-election on 28th May. The government has also increased Value Added Tax (VAT) on a vast range of goods and services. These fiscal policies have come at a challenging time for Turkish citizens, who have been grappling with rampant inflation and a substantial depreciation of the lira, which has fallen nearly 30% against the US dollar this year alone.

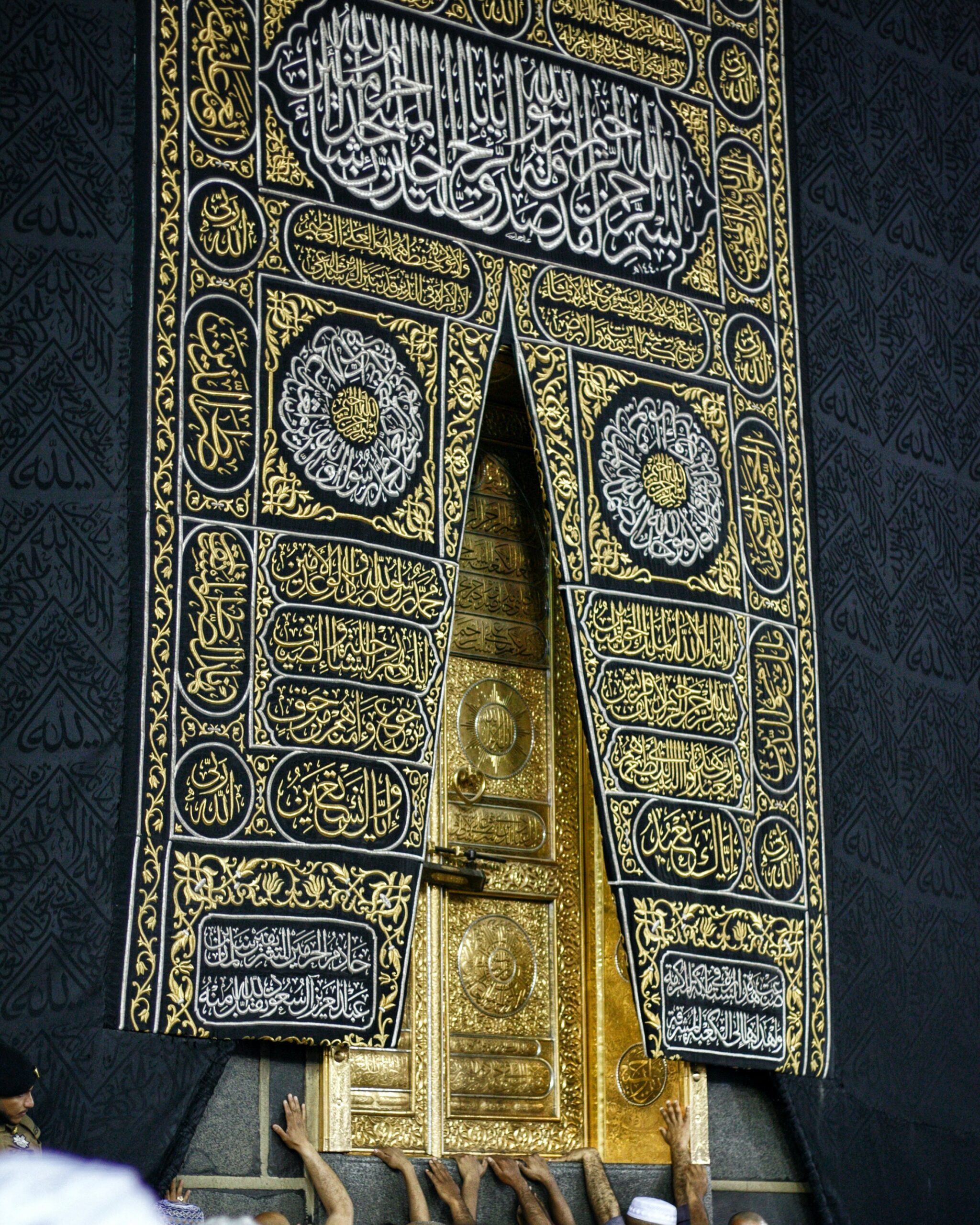

President Erdoğan is set to embark on a diplomatic tour to Saudi Arabia, Qatar, and the United Arab Emirates later this week, with the intention of attracting new investments from these Gulf nations.

Economic analysts have expressed concerns that the weakened lira, coupled with the new taxes, might trigger a resurgence in inflation, which fell to 38.2% in June from an alarming peak of 85.5% in October 2022. The new fiscal approach, which is part of a comprehensive plan by finance minister Mehmet Şimşek to rectify Turkey’s economic trajectory, arrives after a tumultuous period of economic instability brought on by the government’s unconventional policies.

Prior to the May elections, Erdoğan embarked on a massive spending spree, offering a month of free natural gas and increases in public sector wages and pensions. Additionally, the aftermath of February’s earthquake has left Turkey with a reconstruction bill of up to $100 billion. These financial challenges have led economists to predict a significant rise in Turkey’s government budget deficit, estimated to reach 4.4% of GDP this year, a stark increase from just 0.9% in 2022.

Şimşek’s plan also includes cooling domestic demand, which many argue has become excessively high following years of lenient fiscal and monetary policy. The overheated economy has led to a surge in imports, far outpacing exports, which has resulted in a record current account deficit of $37.7 billion in just the first five months of this year. The higher prices resulting from increased taxes could potentially dampen demand for fuel, thus reducing imports, since Turkey is a major energy importer.

Image Credit: Dawn McDonald on Unsplash