The IMF warns Lebanon that they are at risk of spiralling into hyperinflation if the government fails to enact economic reforms, according to the International Monetary Fund (IMF). The warning came as progress towards a sorely needed IMF bailout package has largely stalled.

The country has fallen into the worst economic crisis in its modern history, rooted in decades of corruption and mismanagement. Three-quarters of Lebanon’s population of over six million, including a million Syrian refugees, now live in poverty and inflation is soaring. The preliminary deal reached last year for a $3bn bailout would have to be revisited, as the country’s economic situation has changed, according to the IMF.

Underlying reasons behind IMF warns Lebanon

Lebanon’s economic situation has continued to deteriorate since the onset of its financial crisis in late 2019, caused by decades of corruption and mismanagement by the country’s political class. Inflation is soaring, and three-quarters of the population, including a million Syrian refugees, now live in poverty.

The International Monetary Fund (IMF) has been working with Lebanese officials to develop a bailout package to help the country stabilize its economy, but progress has been slow. The IMF’s latest visit to Lebanon, part of its regular assessments of member countries, resulted in a grim assessment of the country’s prospects.

Ernesto Ramirez Rigo, the head of the IMF mission visiting Lebanon, warned that without reforms, Lebanon is headed for hyperinflation, which would have a lasting impact on the quality of life of many Lebanese. Rigo expressed frustration at the slow rate of progress on reforms required to reach a deal, noting that even the legislation that has been passed to enact reforms has fallen short of the IMF’s requirements.

Lebanon’s currency, officially valued at 15,000 Lebanese pounds to the dollar, is trading at more than 100,000 for $1 on the black market, which is used for nearly all transactions. The pound hit a new low on Tuesday, hitting 140,000 pounds to the dollar, before rebounding slightly.

In response to the crisis, hundreds of protesters, mainly retired soldiers, attempted to break through a fence leading to the government headquarters and parliament building in downtown Beirut before being driven back by security forces using tear gas. The IMF has called for much-needed reforms to be enacted, saying the process has been “very slow” considering the country’s devastating financial situation.

The IMF’s visit comes as negotiations for the bailout package have stalled. A preliminary agreement reached nearly a year ago would have provided a bailout of about $3 billion, but Rigo said that figure would have to be revisited as the country’s economic situation has changed. The IMF called on Lebanon’s leaders to enact reforms, saying the delays can only increase the cost on the Lebanese people.

Lebanese and IMF negotiators reached a staff-level agreement in April last year that depended on an economic recovery plan and a series of crucial reforms. But Lebanese leaders have failed to reach agreement on how to resolve the crisis despite an economic recovery plan adopted by the government in May. One of the main bones of contention is the allocation of financial losses between the main stakeholders: the government, the banks, and depositors.

Mr. Rigo said the state’s participation should be minimal to maintain public debt sustainability. “Any solution needs to ensure that there is debt sustainability. Lebanon is in default … it doesn’t have the capacity to recapitalize the system; that would have been the easy solution, but it can’t do that,” he said. The IMF called for a fair allocation of losses while protecting the value of small depositors as much as possible.

The stakes are high: billions of dollars in relief funding from the IMF could pave the way for releasing other international funding and foreign investment to ease Lebanon out of more than four years of economic crisis. The negotiations with the IMF notably stalled on the state’s contribution to cover the financial losses.

Lebanon is a unique case because of the complexity of the balance sheets between the central bank, commercial banks, and the public sector, and the size of the losses. “The numbers are on such a scale for a country as small as Lebanon that everybody will have to take losses,” Rigo said.

The IMF’s visit comes at a time when Lebanon is facing many other challenges, including political instability and a surge in COVID-19 cases. The country’s caretaker government has been unable to form a new administration for months.

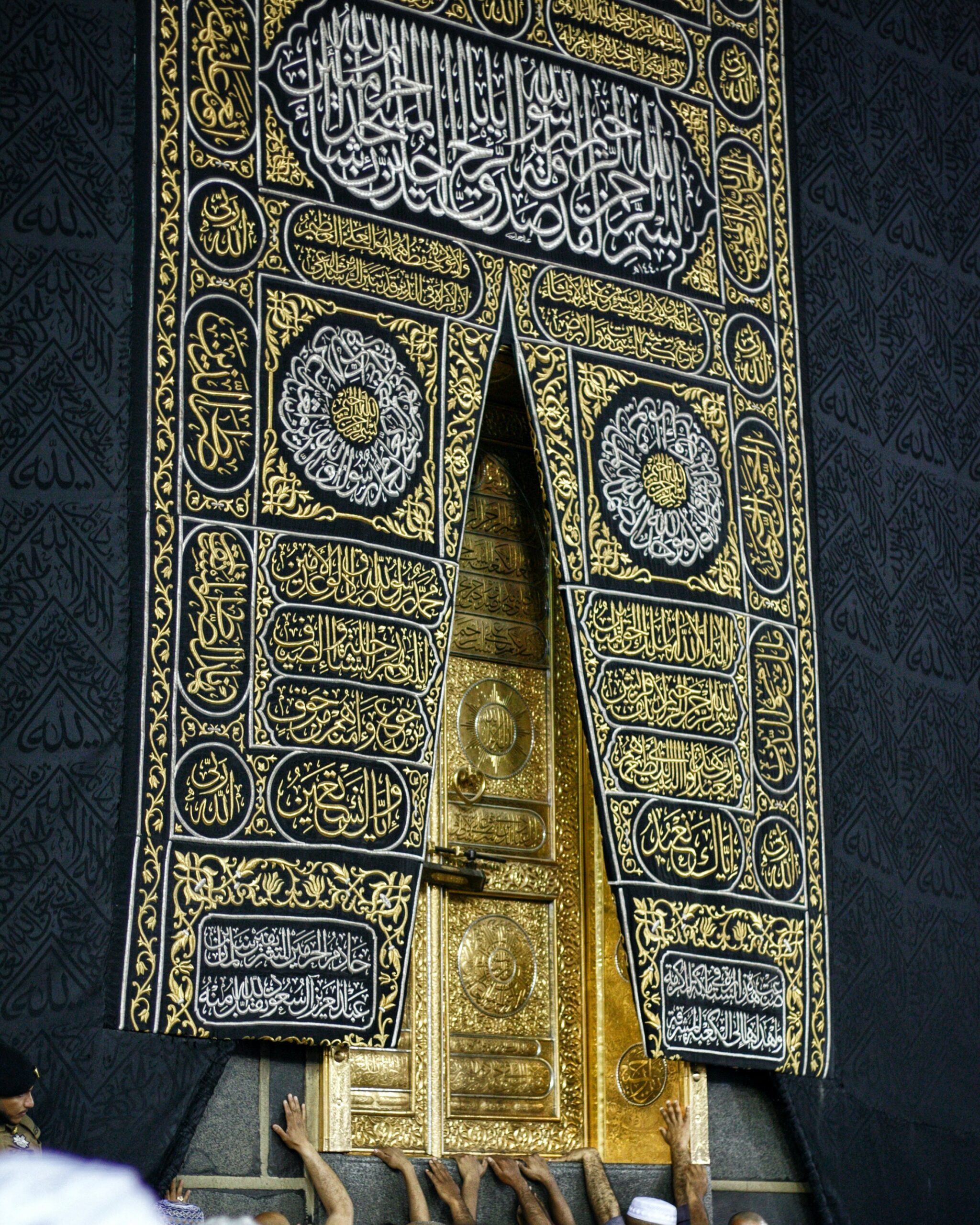

Image Credit: https://www.flickr.com/photos/nasonurb/