In a shocking move, the Iraqi government announced a prohibition on conducting personal and business transactions in US dollars last Sunday, causing a stir amongst those seeking to make substantial purchases. This development symbolises a potential shift in the Middle East’s currency preference, which has, for decades, favoured the US dollar.

Big-ticket purchases such as homes and cars have traditionally been made using dollars in Iraq, owing to the continual depreciation of the dinar. However, stringent regulations from US authorities on the influx of dollars, ostensibly driven by concerns over illicit funds reaching sanctioned Iran, have led to significant volatility in the value of the Iraqi dinar. This dollar drought was the catalyst for Iraq’s recent embargo on dollar transactions.

Iraq isn’t alone in its reconsideration of the dollar’s dominance. Saudi Arabia has expressed openness to trading oil in currencies other than the dollar, including the euro and the yuan, while the United Arab Emirates is considering transactions with India using the Indian rupee.

On a broader scale, several Middle Eastern countries, including Egypt, Saudi Arabia, UAE, Algeria, and Bahrain, have expressed interest in joining the BRICS alliance — Brazil, Russia, India, China, and South Africa — which plans to discuss the introduction of a new currency for cross-border trade at an upcoming meeting in June.

While these developments have triggered alarmist headlines around the world, many experts believe that the transition away from the US dollar is a slower process than the media portrays, particularly in the Middle East. Although statements hinting at a potential shift have been made by several Middle East nations, experts, including Hasan Alhasan of the International Institute for Strategic Studies, emphasise that a de-pegging of Middle Eastern currencies from the US dollar would be the real indication of a significant shift.

Daniel McDowell, a political science professor at Syracuse University, suggests that while the dollar’s supremacy may eventually wane, much of the current rhetoric is symbolic and the imminent change is likely to be marginal and slow. He further noted that the threats to use other currencies by Middle Eastern countries are likely influenced by the conflict in Ukraine and the use of financial sanctions.

Echoing this sentiment, Maria Demertzis, a senior fellow at Bruegel, an economic think tank, stated that the shift away from the US dollar might continue as long as sanctions persist. However, she underscored the complexity of replacing the settlement infrastructure underpinned by the dollar-driven system, hinting at an intricate and drawn-out process.

With the US and Europe’s recent actions of freezing Russian central bank reserve assets, central banks have been transformed into weapons, potentially causing harm to the international financial system. In response, countries in the Middle East are reportedly preparing for a more multipolar global world, with a keen interest in manoeuvring within and outside dollarised zones.

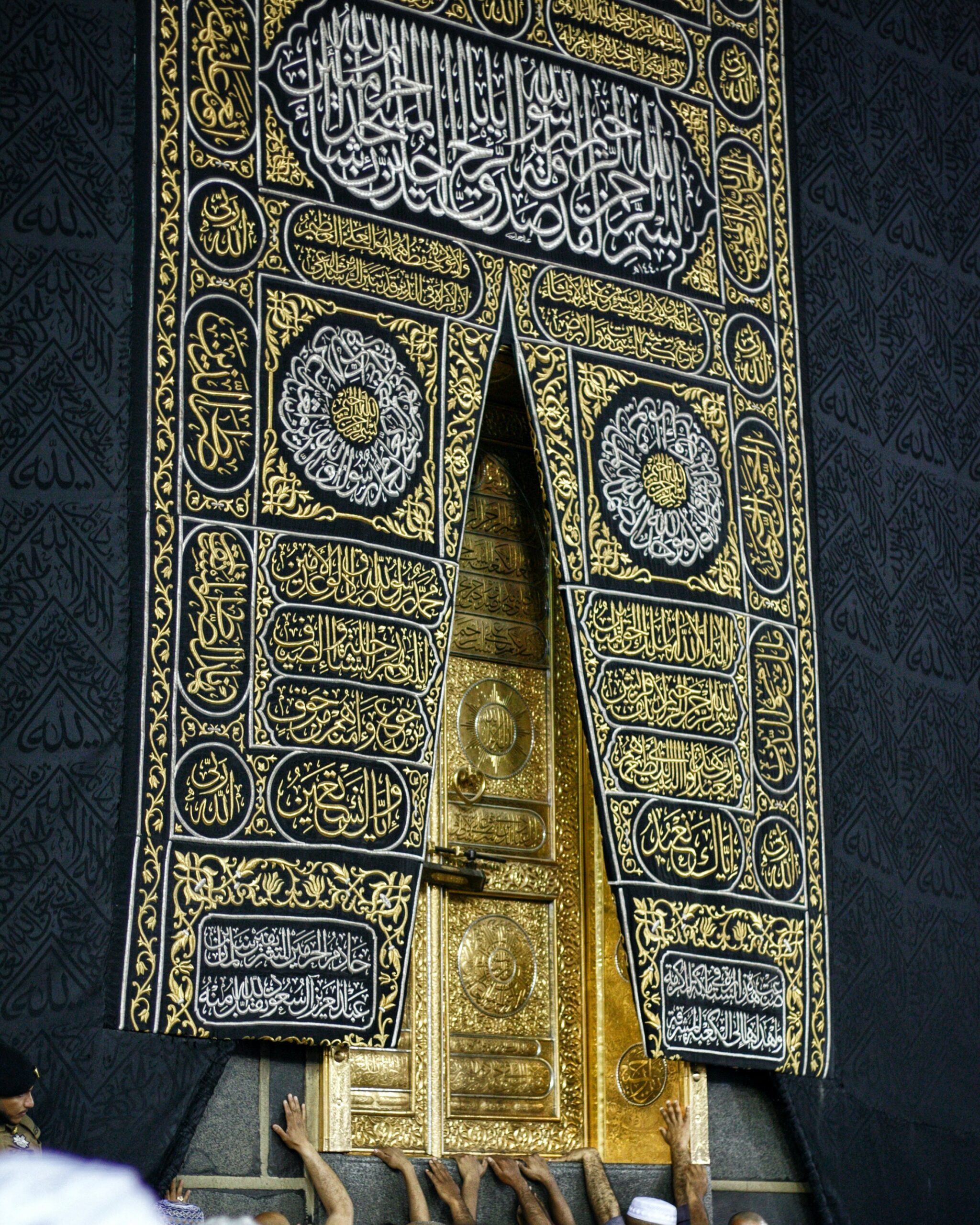

Image Caption: Giorgio Trovato / Unsplash