Amidst Lebanon’s most severe economic turmoil in its brief, tumultuous history, banks from four Arab nations are showing interest in the beleaguered banking sector of the small Mediterranean country. This comes after a three-year economic meltdown that has massively escalated poverty and inflation, hampering the public sector and infrastructure.

Wissam Fattouh, the Secretary General of the Union of Arab Banks, relayed the news to the Associated Press. His statements came during the most significant regional banking conference in Beirut since the catastrophic economic crisis began in October 2019. Caretaker Economy Minister Amin Salam, along with Lebanese and regional banking officials, urged their Arab peers to invest in the crisis-laden country and contribute to its economic resurrection.

Back in July, Fattouh disclosed to the Saudi-owned TV station Al-Hadath that Jordanian and Iraqi banks were considering the purchase of smaller Lebanese banks. He elaborated, “During our numerous visits to Arab countries and meetings with banking leadership, we explored the potential of acquiring some Lebanese banks willing to sell.” However, he refrained from specifying which banks were contemplating an investment in Lebanon.

As of 2022, 61 banks were operating in Lebanon, 46 of which were commercial banks. Due to the crisis, many have had to downsize. The World Bank has labeled Lebanon’s financial crisis as one of the worst globally since the mid-19th century – the result of years of financial mismanagement, corruption, and harmful policy.

Towards the end of 2019, a scarcity of dollars in Lebanon instigated panic, leading to a run on the banks, as strict withdrawal limits were imposed on depositors who kept their savings there. This crisis was exacerbated by what financial experts and the World Bank defined as a Ponzi scheme. Here, the central bank of Lebanon encouraged commercial banks to lend dollars at high interest rates, thereby maintaining liquidity. The banks then enticed customers to deposit their savings in their accounts, offering even higher interest rates.

Subsequently, Lebanon has operated on a cash economy. The Lebanese pound, its local currency, has lost about 90% of its value, primarily influenced by a non-transparent black market rate which has become the norm for most goods and services throughout the country. Desperate for money, depositors have been withdrawing their savings at exchange rates considerably below the market rate.

Regarding the current deposits at the Central Bank, Fattouh commented, “The fate of those deposits is still a mystery. Thus, investors will prefer banks that don’t have high liabilities and only possess some deposits in the Central Bank.”

In April 2022, a preliminary agreement between the International Monetary Fund and the Lebanese government proposed an “externally assisted bank-by-bank evaluation for the 14 largest banks.” However, the audit never materialised as Lebanon’s ruling political parties and officials, many of whom hold shares or own the banks, refused to introduce any reforms.

Lebanon has been without a president since October, and its Central Bank governor resigned earlier this week. Nevertheless, Fattouh believes this presents an opportunity for investors. He suggested, “Once constitutional affairs are in order in Lebanon following a presidential election, a banking license could potentially cost around $200 million. Hence, acquiring a bank now could be less costly and highly profitable in the future.”

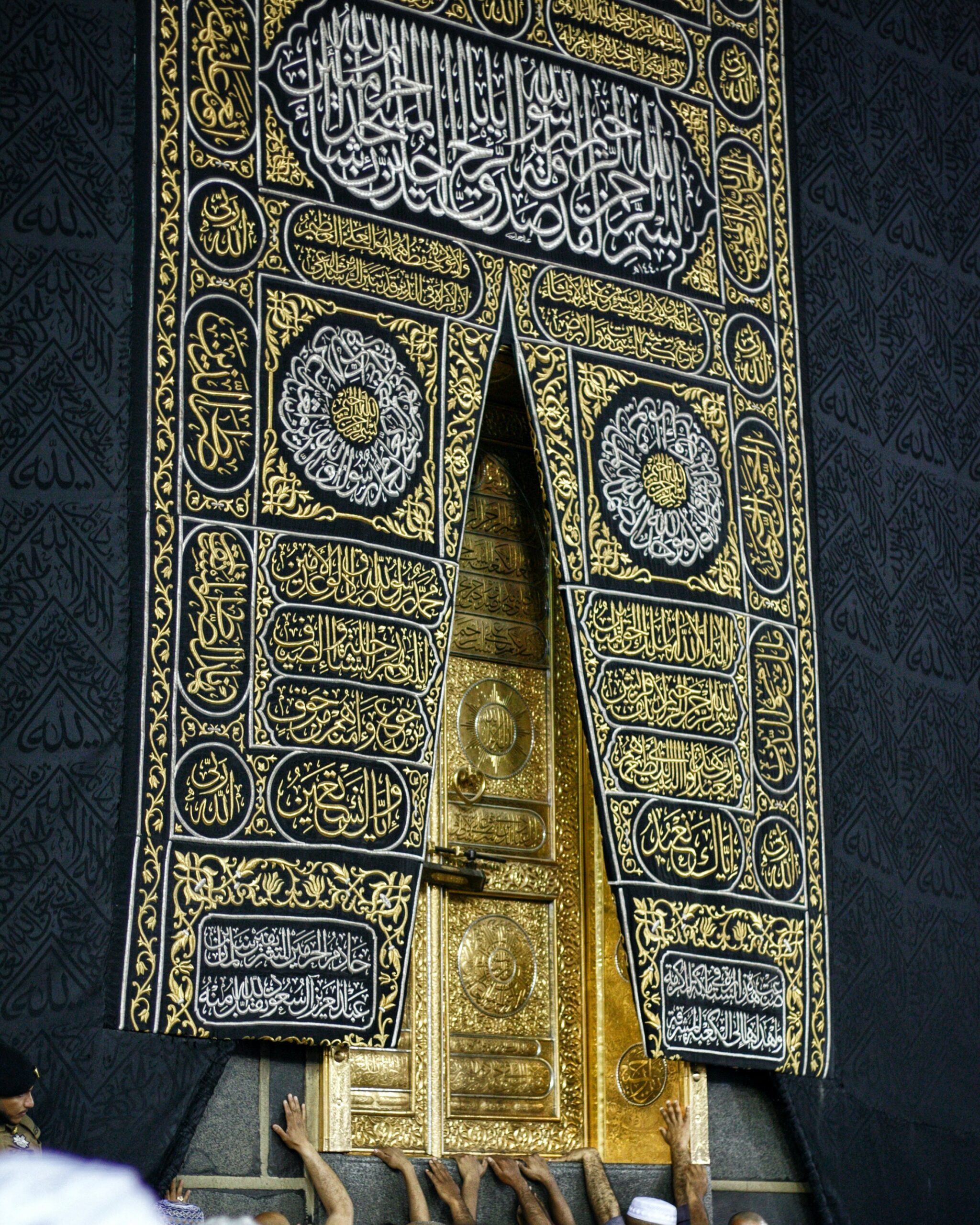

Image Credit: wirestock – www.freepik.com