The International Monetary Fund (IMF) issued a stark warning to Lebanon in a recent report, stating that the small, crisis-ridden country may face persistent triple-digit inflation and could witness its public debt escalate to nearly 550% of GDP by 2027 if crucial reforms are not implemented.

This report is a continuation of the IMF’s oversight following a nine-day visit by its officials in March, which aimed to assess the dire economic situation in Lebanon. Unfortunately, efforts to finalise a desperately needed IMF bailout package have largely been on hold, with scant progress observed in the necessary reforms.

Lebanese officials made a preliminary agreement with the IMF over a year ago, outlining a series of reforms crucial to securing the financial rescue package. These measures include debt restructuring, overhauling its ailing banking system, improving public electricity infrastructure, and enhancing governance. However, since the onset of the economic crisis in 2019, the officials have achieved limited headway.

Lebanon’s economy has severely contracted with the GDP falling about 40%, and the local currency losing 98% of its value. Inflation has skyrocketed into triple digits, and the central bank’s foreign currency reserves have dwindled by two-thirds, the IMF report highlighted.

There was a glimmer of stability towards the end of 2022 due to the cessation of COVID restrictions, an influx of remittances, a rebound in tourism, and a decline in international energy and food prices during the second half of the year. However, the economy’s state remains precariously fragile.

The IMF report also noted the detrimental impact of the delay in Lebanon’s financial system restructuring and currency stabilisation. It has benefited borrowers, particularly in the private sector, who are repaying pre-crisis loans at “below-market exchange rates”. This, however, has resulted in fewer dollar reserves for the banks to repay depositors whose savings are locked within the banks.

Ernesto Ramirez Rigo, the IMF mission chief to Lebanon, cautioned Lebanese leaders that failure to enact these reforms would result in a “disorderly adjustment” of the economy, making Lebanon increasingly dependent on international aid. Rigo added that while there was no specific deadline for Lebanon to implement the necessary reforms to secure the bailout, delays could have grave consequences for the nation.

Despite these hurdles, Caretaker Deputy Prime Minister Saade Chami, who is leading the IMF negotiations, remains hopeful. Although adjustments to the economic figures and plan components will need to be made due to delays in finalising the IMF deal, he asserts that “the main pillars of the program remain the same”. He believes that with political will, Lebanon can steer itself out of the deep economic crisis and onto the path of recovery.

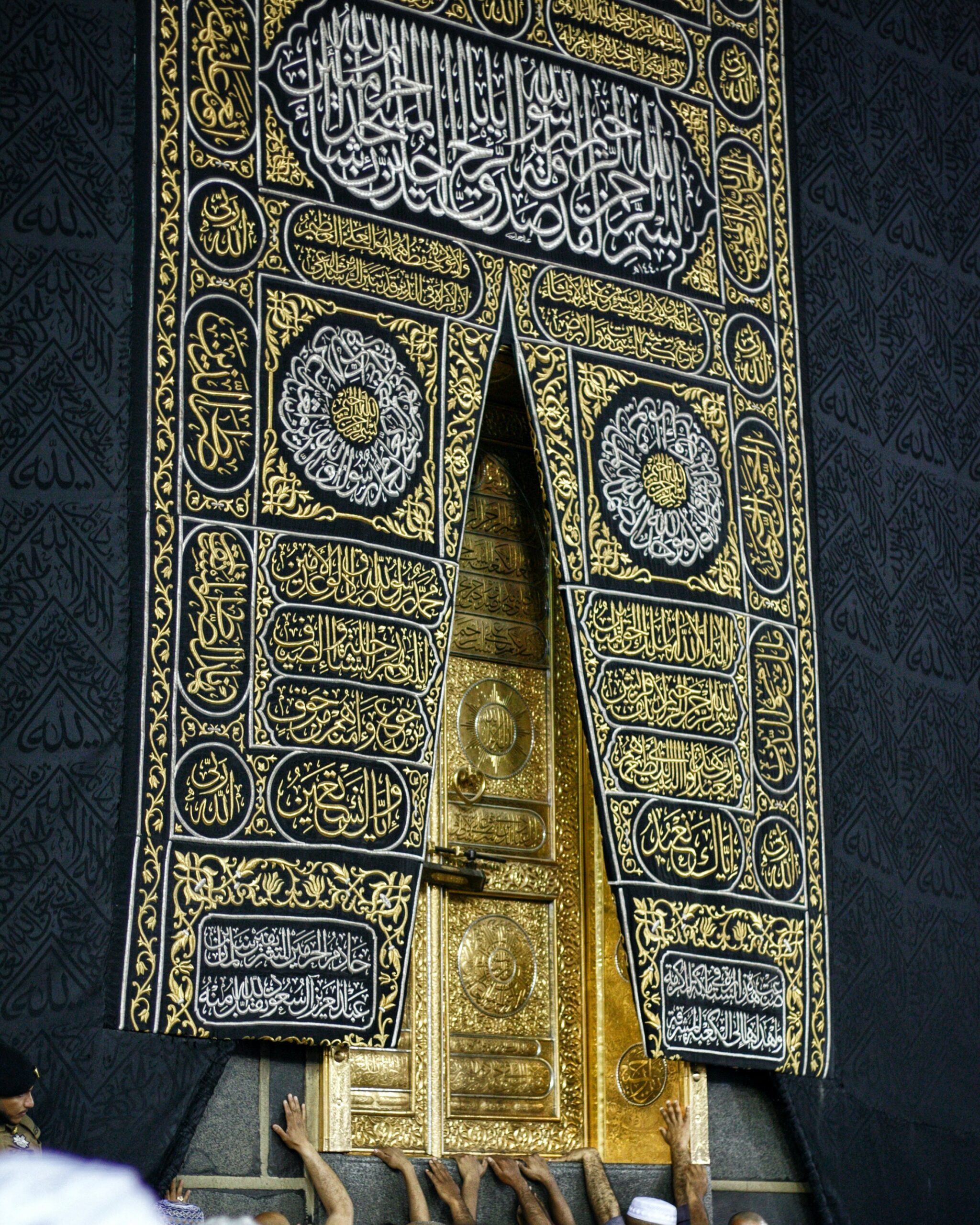

Image Credit: Flickr/nasonurb