The unforeseen mutiny in Russia, which swiftly dissipated, is anticipated to exert minor disruption to oil prices throughout this week, analysts suggest.

Over the weekend, the Wagner Group, a Russian private military company, abruptly terminated their march on Moscow from the southern Russian city of Rostov-on-Don, halting what could have been the first coup attempt in the nation for nearly thirty years.

This abrupt cessation of insurgency came as Wagner Group leader, Yevgeny Prigozhin, ordered his troops to retreat after advancing within 200 kilometres of Moscow.

Rystad Energy, a Norwegian consultancy firm, issued a research note stating, “In light of the brief episode in Russia this weekend reaching its conclusion, we anticipate no significant spike in oil prices.” However, they did note an amplified geopolitical risk amid Russia’s internal instability.

As of Monday morning, Brent crude, which serves as the benchmark for two-thirds of the world’s oil, was trading 0.43 per cent higher at $74.17 per barrel, whilst West Texas Intermediate, the standard for US crude, was up by 0.39 per cent at $69.43 per barrel.

Both benchmarks experienced more than a 3.5 per cent decline last week due to worries about increased monetary tightening from global central banks.

“Despite recent events in Russia, oil markets seem unphased, with Brent and WTI trading up slightly,” said Daniel Richards, a Mena economist at Emirates NBD. Richards notes that no tangible threat to Russia’s oil production exists due to the political unrest, allowing markets to maintain focus on tightening central bank policies and a general deceleration in economic activity.

The International Energy Agency and Opec expect the oil market to tighten during the second half of the year due to Opec+ cuts and rebounding Chinese crude demand. However, analysts suggest that sturdy Russian crude supply, coupled with escalating output in countries under sanctions such as Iran and Venezuela, could potentially cause a lesser deficit in 2023.

Major investment banks like Goldman Sachs, MUFG, and UBS, have recently reduced their short-term oil price projections, due to an unexpected surge in the crude supply in the market.

Since the outset of 2023, Brent has dropped nearly 14 per cent of its value, amid escalating fears of a global economic slowdown.

Goldman Sachs, in a Friday research note, highlighted that much of the oil market’s instability over the past year reflects the policy and market response to the surge in prices during the first half of 2022.

According to the US investment bank, Brent reached nearly $140 a barrel after Russia invaded Ukraine last year, resulting in record releases from America’s emergency crude reserves and aggressive interest rate hikes from central banks.

The bank projects that oil prices will unlikely match the 2022 peak within the next year, given unexpected increases in crude production in the US and sanctioned countries.

Goldman Sachs also noted that despite a rise of 8 per cent in global investment in oil and gas projects last year, the figures still lingered 40 per cent below 2014 levels. This trend remained, despite significant price increases.

In the long term, the price cap on Russian crude exports – a move meant to maintain market stability while reducing Moscow’s revenues – could potentially shift power from producers to consumers if it sets a precedent for future sanctions, Goldman Sachs warned.

While the bank acknowledged that the energy crisis had not caused any substantial harm to crude demand, it predicted a long-term decline in oil consumption due to the rise in investment in clean energy and electric vehicles.

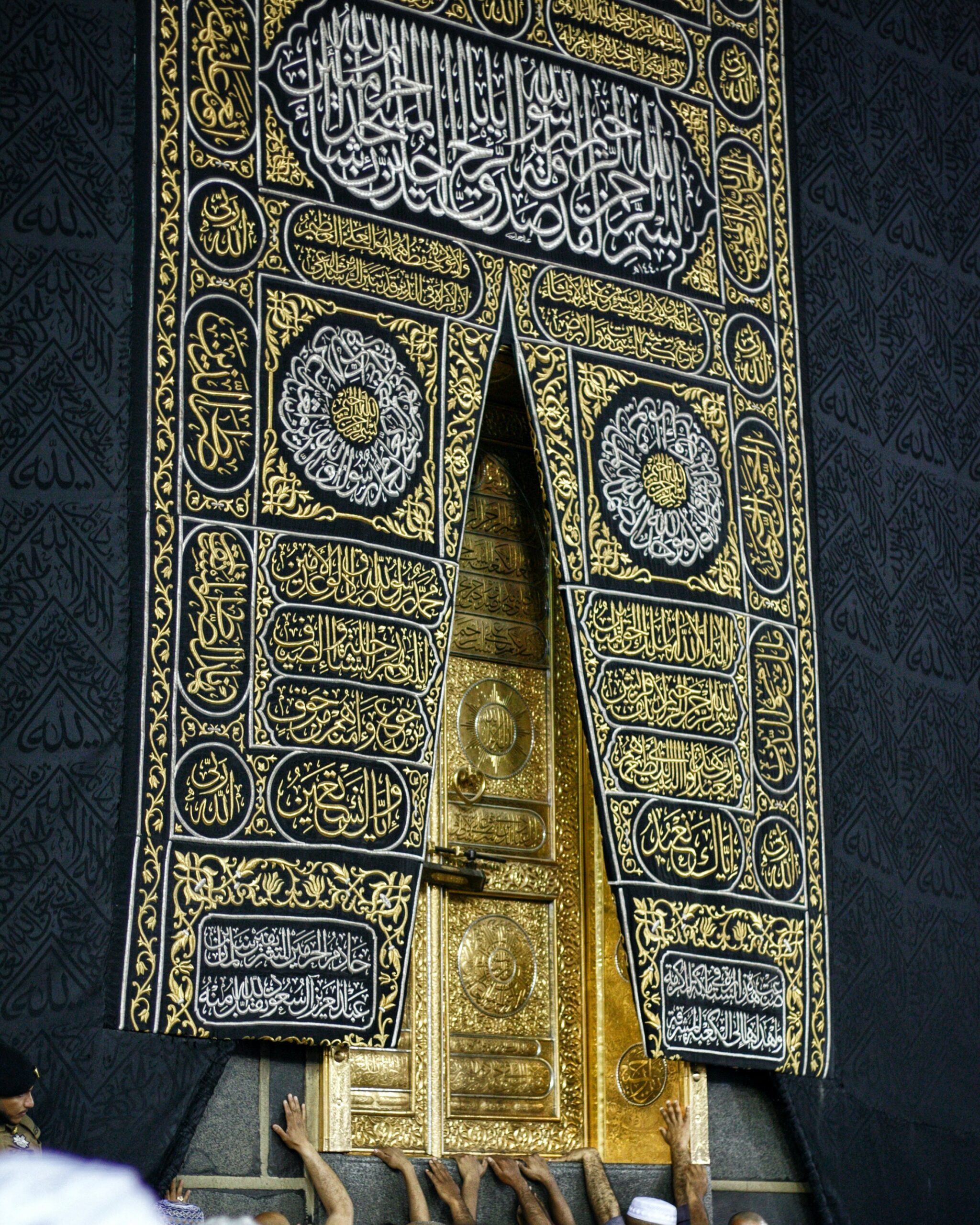

Image Credit: Zbynek Burival on Unsplash